When I refinanced my private and federal student loans this year, I saved over $1,000 per year! That’s all cash that would have been handed over for just interest payments – not money paying down what I owe. If you’re paying more than you need to in interest, you’re throwing your cash money dollars down the crapper. It pays to investigate whether you can get better rates!

What follows is a detailed review of 2 really great places to refinance: SOFI and Darien Rowayton Bank. I refinanced through both. You’ll also find a chart to easily get a rough estimate on how much money you could save next year. All info is current as of 11/8/15.

If you’d rather skip the following info and go right to starting the refinancing process, please go HERE to be referred by me to either company and possibly earn me a finder’s fee!

I first refinanced private loans with horrendous interest rates through SOFI. One of the loans charged over 9% interest annually before I switched over! At the time, my goal besides saving money was to pay off my loans faster. By the way, the shorter the repayment term (the faster you pay it off) the lower the rate you will generally be charged in interest.

I chose a 10-year, variable rate term. For variable loans, SOFI bases the interest rate they charge on the one-month LIBOR index, which can change monthly. It’s a bit of a risk, but considering I was already paying over 9%, not much of one for me. The rate will never go higher than what SOFI states as the cap – which as of today is advertised at 8.95% APR for 5, 7 and 10 year terms and 9.95% APR for 15 and 20 year terms.

I hemmed and hawed over picking a rate, and called up SOFI’s customer service about it. I was told I could refinance at any time, so if I chose to go to a longer repayment term later, no worries. (That ended up not being exactly true, by the way.) If you remove my decision-making time, the total refinancing paperwork and disbursement time was about a month. That’s really good!

The interest rate they ended up offering after all the paper pushing on their end was 4.055% variable APR for the 10-year term. After a 0.25% discount for setting up automatic payments, the rate became 3.805% variable APR. This was for a loan of over $11,000 to pay off multiple loans, with the average rate for the whole ball being something over 7% fixed APR. So, I looked at that and was able to roughly say, hey I’m probably saving at least 3% next year on a >$10,000 loan, so that means I’m saving at least 0.03x$10,000 = $300. That’s $300 more in my pocket versus the bank’s pocket over the next 12 months, while paying about the same monthly amount. Winning.

One of the reasons I stalled on deciding a repayment term, was I thought one’s salary would impact the rate offered more than credit score, and my salary needed to increase dramatically anyways. After I received my final offer package from SOFI, my hunch about how income would affect rates seemed to be confirmed. I found out I had SHOCKINGLY good credit: 833 FICO! It was especially surprising considering how hard the Great Recession had screwed me years ago. Yet, somehow, I wasn’t even offered the mid-range of rates for that repayment term – it was higher than the middle of the range. I talked with other SOFI customers at a mixer they through in Chicago, and some of them shared my hypothesis. I can’t say for sure how much income is weighed vs. credit score, but it’s something to keep in mind.

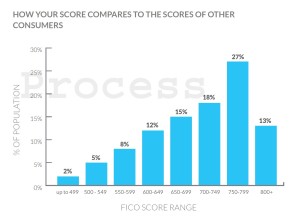

For an idea of how good an 833 FICO score is, here is the chart included in my offer package from SOFI in April 2015:

Several months later, I decided I wanted to change strategies. Instead of paying off my loans as fast as possible, I wanted to push out my payment term as far into eternity as possible, thereby lowering my monthly commitment. You know, in case I decided to quit my job and live off my savings in a foreign country or something. I still had about a $400 monthly ball chained to my leg, and that’s almost a month’s worth of rent in some places!

I tried to go back to SOFI and push my 10-year term out to a 20-year term, because the process had gone so smoothly. For whatever reason, when I tried to refinance the same loan again, they no longer offered me a 20-year term as an option. That’s when I turned to Darien Rowayton Bank, or DRB.

The rates were better than what SOFI offered, as I’d read many other people experienced, but be forewarned: they have more demand than they can handle, and it could take a very long time to process. It took about 2 months for my first loan to be refinanced, and their online application process is a confusing mess. I got several “oops” emails from the automated system saying I needed to submit things I had already submitted weeks ago. BUT, those rates! And once you set everything up, it should be smooth sailing afterward. So, if you can deal with a bit of annoyance and some extra time to get things started, it’s totally worth it.

This time, I got my hellish Sallie Mae loans – the bulk of my student loan debt, about $30,000 – repacked into something much friendlier. Sallie had me by the apples for over $260 each month and charged over 6% interest. I asked DRB to give me a ridiculously long 20-YEAR variable rate loan for the whole shebang. They offered a 4.03% variable interest rate with the same 0.25% deduction if you do automatic payments, so 3.78%. My monthly payments are now about $180/month for this chunk. DRB bases their rate on the 3-month LIBOR (as opposed to SOFI’s one-month), and it’s capped at 10%. There is an extra bit of complication with DRB here, as you need to open a checking account with DRB for automatic payments, but that part of the process went relatively smoothly. The DRB checking account can automatically deduct from another personal checking account you hold with another bank a few days before your loan is due and then make your payment automatically and on time.

With DRB, I saved around 2.7% APR on about $30,000. So, that’s 0.027x$30,000, or over $800 that will be going to my bottom line instead of the bank’s over the next year. Of course, as the principal gets paid down, I’ll be paying less in loan interest anyways, but this still serves as a good rough idea. Plus, who are we kidding, I was barely making a dent in my Sallie Mae loans anyways.

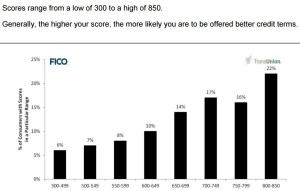

The credit score DRB found for me through TransUnion in August 2015 was 810. This was lower than the 833 SOFI found for me, but still very good. I’m not sure if the difference stemmed from different credit checking sources or just the fact that the SOFI refinancing required a pull on my credit score, or both. Otherwise, my financial picture was exactly the same, if not a little better, as I had more cash in savings in August. Whatever the case, if one company turns you down or gives you terms you don’t love, it may be a good idea to try out the other. Here is the very different credit score chart included in my package from DRB:

After I found out DRB would still offer me a 20-year loan term, and at great rates, I refinanced my SOFI loan through DRB, as well.

After all my playing around with the loans, my final savings in interest payments was over 1,000 bucks per year, and my monthly payments went from around $400 to $250.

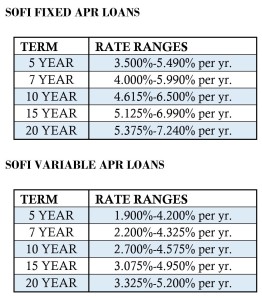

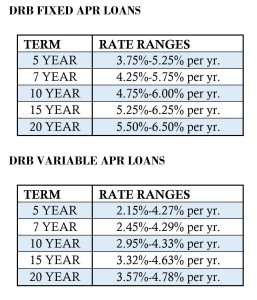

So how much money can you put back in your pocket? Well first, here are the rate ranges and terms offered by SOFI and DRB as retrieved online 11/8/2015.

SOFI Rates and Terms, pulled 11/8/2015 from THIS LINK:

DRB Rates and Terms, pulled 11/8/2015 from THIS LINK:

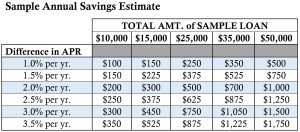

If your current rates are higher than these, you can subtract your current rate by something in the stated ranges and see roughly what you could save in a year. So, for example, if you wanted to refinance a loan for $30,000, and you expect to still owe about $25,000 worth of it in 12 months, you can use the $25,000 column under “TOTAL AMT. of SAMPLE LOAN” below. Then, you can see what lower APR’s could save you in cash for a year. Say that $30,000 loan is sitting in Sallie Mae’s hands with 7% APR fixed rate. If you want to see what going to a 5-year fixed rate loan at SOFI could save you, subtract 7% APR by something in the range listed in the charts above. If you assume you’d get a 5% APR with SOFI, that means the difference in APR is 7%-5% = 2.0% Difference in APR.

So, take that $25,000 column, follow it down to the “2.0% per yr.” Difference in APR row, and you get a super rough estimate of $500 savings for you over the next year. If you want a more precise estimate, the refinancing companies have calculators as you’re going through the process, but this should give you an idea if it’s worth your time in the first place. And remember, you’ll be saving over the life of your loan, not just over the next year! …But you’ll (hopefully) be saving less as time goes on because you’ll owe less.

If you’re ready to look into refinancing with either SOFI or DRB or both, please let me refer you. If you follow through with the refinancing, you could score me a referral bonus, and I would appreciate it very much!

For SOFI, you can CLICK HERE and get started right away.

For DRB, you can CLICK HERE and fill out the form. I’ll manually refer you and DRB will contact you from there.

Some caveats:

- You need Amaziballs Credit

- You need either a specific degree (DRB) or to be a graduate of a preferred university (SOFI)

- As of info posted today (11/8/2015), the minimum amount you can refinance is $5,000 through DRB or $10,000 through SOFI

- The rates and terms posted here are subject to change

Good luck and feel free to ask any questions about student loan refinancing!